Saving money is not about keeping whatever is left at the end of the month. It’s about planning to grow your money and being prepared for life’s surprises. If you are a young professional in India, saving early can help you achieve your dreams and be financially secure. Here’s how you can start your savings journey.

Why Saving Matters

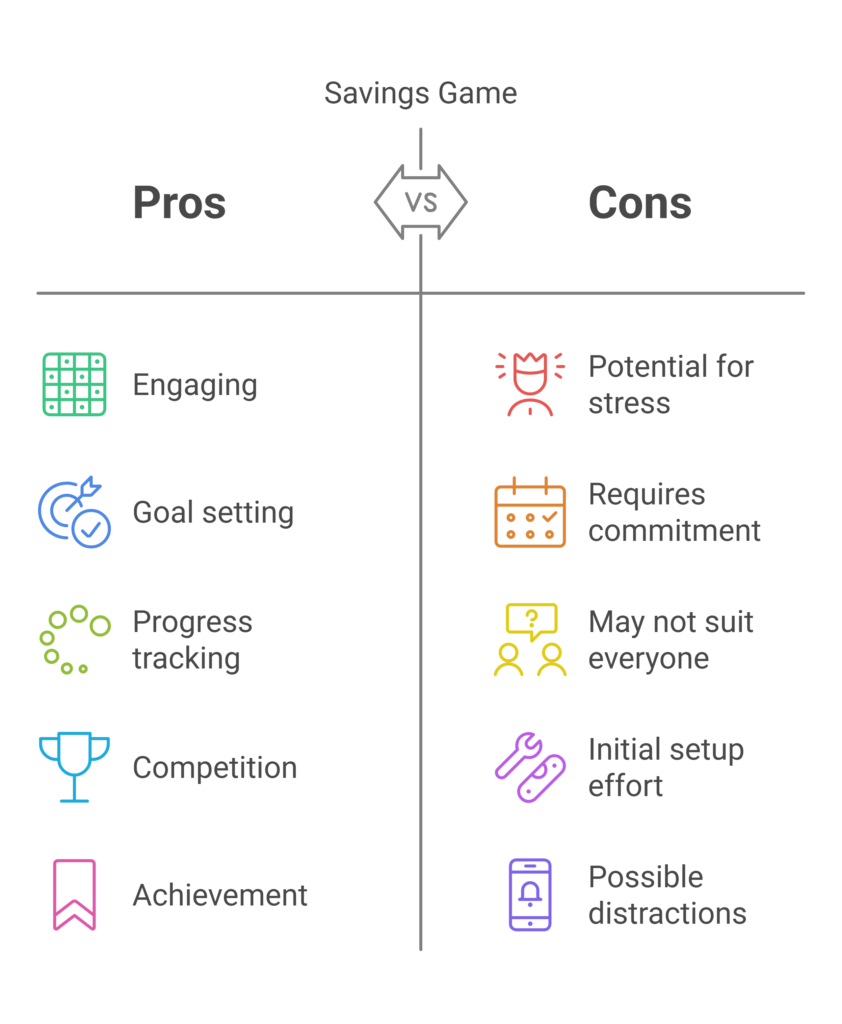

Savings game money gives you more than just a cushion. It opens doors to opportunities and helps you feel secure. Below are a few points to start saving now:

- Emergency Support: Unexpected expenses like medical bills or car repairs can come up anytime. Savings can help you handle them without stress.

Example: Imagine your bike needs urgent repairs costing ₹10,000. An emergency fund can cover this without disturbing your monthly budget. - Financial Independence: Having savings means you don’t have to depend on others to make important decisions.

Example: Want to take a break from work and pursue a short-term course? Savings can help you make that happen. - Achieving Dreams: Your savings game make your goals possible, whether you’re traveling, buying a home, or studying further.

Example: Saving ₹5,000 every month for a year can give you ₹60,000 to fund your dream vacation. - Building Wealth: Saving regularly helps grow your money, especially when invested. Example: Investing ₹2,000 per month in mutual funds with an 8% annual return can grow to over ₹6 lakhs in 15 years.

Steps to Start Saving Effectively

1. Set Clear Goals

Know why you’re saving. Split your goals into these categories:

- Short-Term Goals: Things you want soon, like a new phone or a trip.

Example: Planning to buy a smartphone worth ₹25,000 in six months? Save ₹4,200 per month to reach your goal. - Medium-Term Goals: Plans for the next 2-5 years, like buying a bike or funding your wedding.

Example: Save ₹5,000 per month for three years to have ₹1.8 lakhs for your dream bike. - Long-Term Goals: Big dreams like retirement, buying a house, or securing your future. Example: Invest ₹10,000 monthly in a PPF account to build a strong retirement corpus over 15 years.

When you have clear goals, saving becomes more focused and rewarding.

2. Create an Emergency Fund

This is your first step to financial security. Save enough to cover at least 3-6 months of your basic expenses. Keep this fund separate and easily accessible.

Example: If your monthly expenses are ₹20,000, aim for an emergency fund of ₹1.2 lakhs to stay prepared for any surprises.

Tip: Use a high-interest savings account or a liquid mutual fund for your emergency fund.

3. Save Before You Spend

As soon as you get your salary, put aside a fixed amount for savings. Automate this step so you don’t forget.

Example: If your monthly income is ₹50,000, save ₹10,000 as soon as you get paid. Over a year, this adds up to ₹1.2 lakhs.

4. Track Your Spending

To save better, you need to know where your money is going. Use apps like Walnut or MoneyView to see how much you spend and where you can cut back.

Example: If you’re spending ₹3,000 a month on eating out, cutting it down to ₹1,500 can free up ₹18,000 annually for savings.

Tip: Small changes like eating out less or skipping expensive coffee can help you save more.

5. Follow the 50/30/20 Rule

This rule makes budgeting easy:

- 50% for Essentials: Rent, food, bills, and transportation.

- 30% for Personal Wants: Hobbies, shopping, or entertainment.

- 20% for Savings: This goes into your emergency fund or investments.

Example: If you earn ₹40,000 a month, allocate ₹20,000 for essentials, ₹12,000 for personal wants, and ₹8,000 for savings game.

6. Start Small, Be Regular

If saving feels hard, start with a small amount and increase it gradually. The habit is more important than the amount.

Example: Begin with ₹2,000 per month and increase by ₹500 every six months. In two years, you’ll be saving ₹5,000 monthly.

7. Avoid Lifestyle Inflation

When your income rises, it’s tempting to spend more. While it’s fine to enjoy some of it, ensure you also increase your savings game.

Tip: If you get a raise of ₹10,000, save ₹5,000 and use the rest for personal goals or treats.

8. Invest Your Savings

Money sitting idle loses value due to inflation. Invest your savings to make them grow:

- Fixed Deposits (FDs): Safe and offer guaranteed returns.

- Mutual Funds: SIPs (Systematic Investment Plans) can give higher returns over time. Example: Investing ₹3,000 monthly in an equity mutual fund can grow to ₹7.5 lakhs in 10 years at a 10% return.

- Public Provident Fund (PPF): Long-term savings with tax benefits.

- Stock Market: For those willing to take some risk for higher returns.

Tip: Diversify your investments to balance safety and growth.

Common Problems and Solutions

“I Don’t Earn Enough to Save”

Start with a small amount. Saving even ₹500 a month adds up over time. Gradually increase your savings game as your income grows.

Example: ₹500 saved monthly at 8% annual interest becomes almost ₹40,000 in five years.

“Unexpected Expenses Keep Coming Up”

This is why you need an emergency fund. It’s for real emergencies, not regular expenses.

Example: Use your emergency fund to pay for an unexpected ₹15,000 medical bill without disrupting your savings plan.

“I Can’t Stick to a Savings Plan”

Set up automatic transfers to your savings account. This way, you save without even thinking about it.

Tip: Use cash or UPI for daily spending to avoid overspending.

Handy Tools to Save Money

Here are some apps and tools that can help:

- ET Money: Track your expenses and manage investments.

- Groww: A simple platform for mutual fund and stock investments.

- Scripbox: Offers goal-based investment plans.

- Google Sheets: Great for keeping a manual record of your spending and savings.

Benefits of Saving

- Peace of Mind: Knowing you have savings reduces stress.

- More Choices: You can make decisions like switching jobs or starting a business without worry.

- Achieve Your Goals: Savings make your dreams a reality, whether it’s buying a car or retiring early.

- Stay Secure: You’ll be ready for emergencies and financial downturns.

Final Thoughts

Saving money doesn’t mean giving up everything you enjoy. It’s about striking a balance between living your life today and securing your future. Start small, stay consistent, and make saving a habit. Over time, you’ll see the rewards, and you’ll have the freedom to live life on your terms.