Investing for beginners can feel overwhelming, especially for those new to the financial world. However, this guide aims to demystify the process and empower you with the knowledge to begin your investment journey. Understanding the basics of investing is key whether you want to build wealth, save for retirement, or generate passive income. Let’s dive into what you need to know to get started.

Why Invest?

The Importance of Investing for beginners

Investing isn’t solely for the wealthy or financially savvy; it’s for anyone looking to secure their financial future. Here are a few compelling reasons to consider investing:

- Wealth Growth: Investing your money can yield higher returns than simply saving it in a bank account. Over time, compounded interest and capital gains can significantly increase your wealth.

- Achieving Financial Goals: Do you dream of buying a home, funding your child’s education, or retiring comfortably? Investing can help you reach these milestones by providing a path to grow your savings.

- Generating Passive Income: Certain investments, such as dividend-paying stocks or rental properties, can provide ongoing income without requiring you to work for it.

- Beating Inflation: With inflation eroding purchasing power, investing helps your money grow at a rate that outpaces inflation, ensuring that your savings retain value over time.

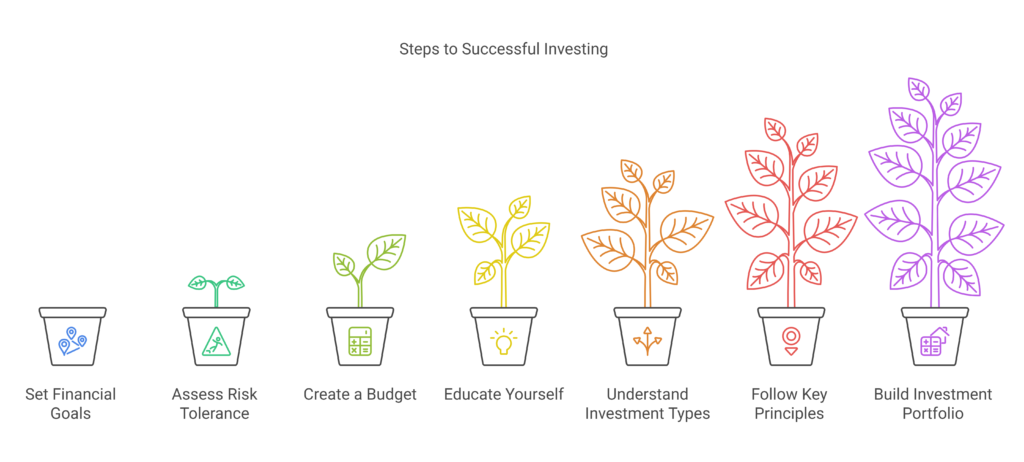

Getting Started with Investing for Beginners

Before you jump into specific investment types, there are some foundational concepts you need to understand. Here are a few steps to consider:

1. Set Clear Financial Goals

Define what you want to achieve with your investments. Are you saving for a short-term goal, like a vacation, or a long-term goal, such as retirement? Understanding your goals will inform your investment strategy.

2. Assess Your Risk Tolerance

Risk tolerance reflects your comfort level with the possibility of losing money in your investment portfolio. Factors influencing this decision include your financial situation, age, and experience with investing. A younger investor might be more willing to take on higher risks compared to someone nearing retirement.

3. Create a Budget

Examine your financial situation to determine how much money you can allocate toward investing. It’s essential to have a budget that takes into account your essential expenses while setting aside funds for investments.

4. Educate Yourself

Knowledge is crucial in the world of investing. Familiarize yourself with basic investment concepts, market trends, and different asset classes. Books, reputable financial websites, and online courses can be excellent sources of information.

Types of Investments to Consider

Understanding the various types of investments available to you is crucial for making informed decisions. Here’s a breakdown of some of the most common investment options:

1. Stocks

What Are Stocks?

When you buy stocks, you purchase a share of ownership in a company. Stocks are traded on exchanges, and their prices fluctuate based on market conditions.

Advantages:

- High Potential Returns: Historically, stocks have provided higher long-term returns compared to other asset classes.

- Dividends: Some companies pay dividends, which can provide regular income.

Example: If you buy 10 shares of a company for ₹100 each, your total investment would be ₹1,000. If the stock price rises to ₹150, your shares would now be worth ₹1,500, giving you a profit of ₹500.

2. Bonds

What Are Bonds?

Bonds are debt instruments issued by corporations or governments. When you purchase a bond, you’re lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity.

Advantages:

- Lower Risk: Bonds are generally considered safer than stocks, making them suitable for conservative investors.

- Predictable Income: Bonds provide fixed interest payments, offering stable income.

Example: If you buy a government bond worth ₹10,000 with a 5% annual interest rate, you would earn ₹500 each year until it matures.

3. Mutual Funds

Mutual funds pool money from many investors to buy a diversified portfolio of stocks, bonds, or other securities. A professional fund manager oversees the fund.

Advantages:

- Diversification: Mutual funds help spread risk by investing in a variety of securities.

- Professional Management: Fund managers make investment decisions on behalf of investors, saving you time and effort.

Example: Suppose you invest ₹10,000 in a mutual fund focused on large-cap stocks. If the fund appreciates by 10% over a year, your investment would grow to ₹11,000.

4. Exchange-Traded Funds (ETFs)

What Are ETFs?

ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They can cover a wide range of asset classes.

Advantages:

- Flexibility: You can buy and sell ETFs throughout the trading day.

- Lower Fees: ETFs generally have lower expense ratios compared to mutual funds.

Example: If you invest in an ETF that tracks a stock index, the value of your investment will move in tandem with that index, allowing you to benefit from market growth.

5. Real Estate

What Is Real Estate Investing?

Investing in real estate means purchasing property for income or appreciation. This can include residential, commercial, or rental properties.

Advantages:

- Tangible Asset: Real estate is a physical asset that can appreciate over time.

- Rental Income: Properties can generate ongoing income through rent.

Example: If you buy a rental property for ₹50 lakh and charge ₹25,000 a month in rent, this would yield a steady income stream while the property’s value may appreciate over time.

Key Principles to Guide Your Investing Journey

Successful investing goes beyond picking the right assets. Here are some essential principles to keep in mind:

1. Start Early and Invest Regularly

The earlier you begin investing, the more time your money has to grow. Regular contributions, even small ones, can accumulate significantly with compound interest.

2. Diversify Your Portfolio

Don’t concentrate all your investments in one asset class. Diversifying helps manage risk and enhance potential returns. A mix of stocks, bonds, and other investments can provide a balanced approach.

3. Maintain an Emergency Fund

Before aggressively investing, make sure you have savings set aside for emergencies. Aim for three to six months’ worth of living expenses in an easily accessible account.

4. Keep a Long-Term Perspective

Investing is a long-term game. Market fluctuations are normal, so it’s essential to avoid knee-jerk reactions based on short-term movements. Stay focused on your goals.

5. Stay Informed

The investing landscape is constantly evolving. Keep yourself updated on market trends, economic changes, and new investment opportunities. Continuous learning will enhance your decision-making skills.

Creating Your Investment Portfolio

Building a well-structured investment portfolio requires a thoughtful approach. Here’s how to create a portfolio based on varying risk tolerance levels:

Example 1: Conservative Portfolio

- Allocation: 70% bonds, 20% stocks, 10% cash

- Expected Outcome: This setup is ideal for risk-averse investors, offering stable returns with low volatility.

Example 2: Balanced Portfolio

- Allocation: 50% stocks, 30% bonds, 20% real estate

- Expected Outcome: This balanced strategy is suitable for moderate-risk investors, combining growth potential with income stability.

Example 3: Aggressive Portfolio

- Allocation: 80% stocks, 20% bonds

- Expected Outcome: This aggressive approach is for younger investors willing to accept higher risk for greater potential returns.

Conclusion

Investing is a valuable tool for building wealth and achieving financial independence. By understanding the different types of investments, setting clear goals, and adhering to sound principles, you can embark on a successful investment journey.

Remember, investing is not a get-rich-quick scheme but rather a long-term strategy that requires patience and discipline. Take the time to educate yourself and make informed decisions based on your financial situation and goals. With commitment and the right knowledge, you can navigate the investment landscape confidently and set yourself up for a secure financial future.

Happy investing!