Starting your financial journey as a young professional in India can feel overwhelming. Financial planning often takes a backseat to the pressures of managing your first job, paying off student loans, and balancing your social life. But it’s important to start early to build a secure future. So for that Let’s move on to a detailed guide to help you take control of your finances and build a strong foundation of financial planning.

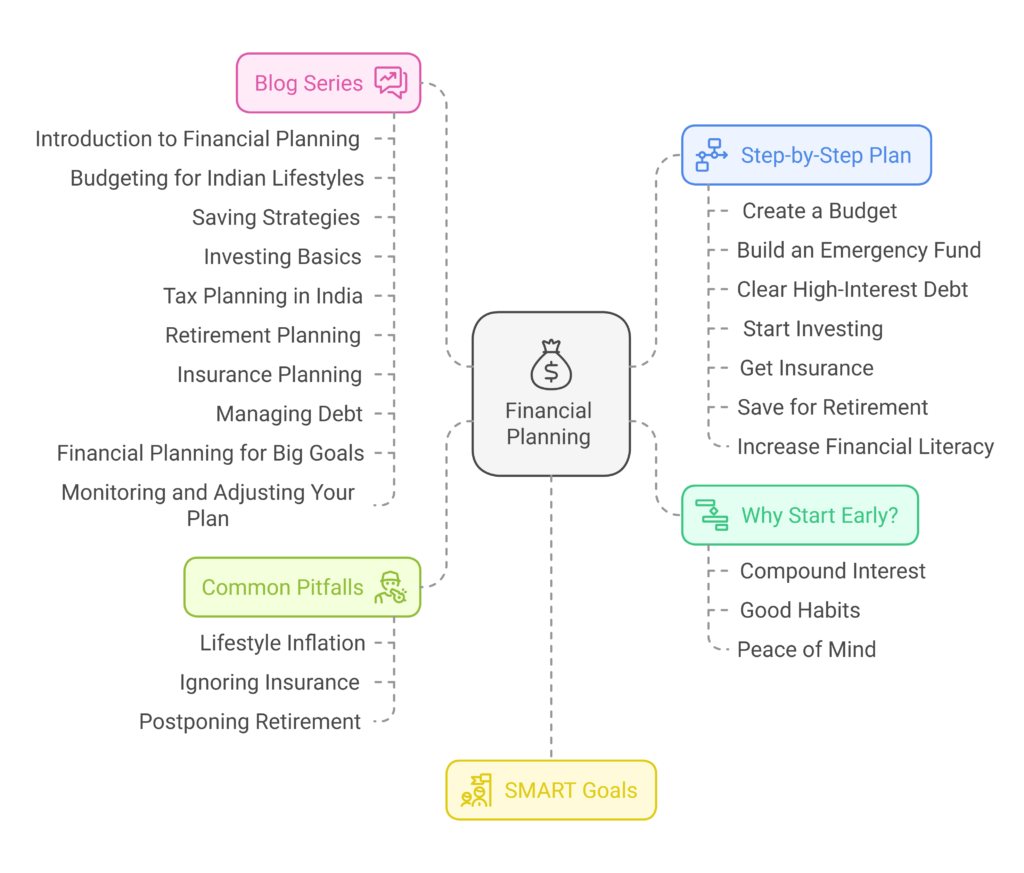

Why Start Financial Planning Early?

The Power of Compound Interest

Saving and investing early can make your money grow faster over time. For example, investing ₹5,000 per month from age 25, assuming 10% annual returns, can grow to ₹1.5 crore by age 60—a realistic expectation for equity investing in India. Or the takeaway? The sooner you start, the longer your money will work for you.

Building Good Habits

By developing good financial habits early, you’re ready to tackle life’s milestones, whether it’s buying your first car, traveling the world, or saving for a wedding. Consistency in tracking savings and spending creates discipline that pays off in the long run.

Peace of Mind

Knowing you have a financial plan reduces stress. Whether it’s an emergency fund for unexpected expenses or a growing retirement fund, financial planning gives you the freedom to focus on your personal and professional growth.

Common Financial Pitfalls for Young Professionals in India

Lifestyle Inflation

As your income increases, the temptation is to improve your lifestyle—a better phone, more frequent dining, or branded clothes. Treating yourself occasionally is fine, but letting your expenses grow at the same rate as your income can dwarf your savings goals..

Ignoring Insurance

Many young professionals skip health and term insurance at this stage, deeming it unnecessary. However, unexpected medical emergencies or accidents can take a significant financial toll without insurance.

Postponing Retirement Savings

Retirement may seem far away, but starting early means you’ll need to save less each month. Delaying even after five years can significantly reduce your final funds due to the loss of compounding benefits.

Setting SMART Financial Goals

Your financial goals should be SMART:

– Specific: Define what you want to achieve. For example, “Save ₹2 lakh for a Goa trip in 12 months.”

– Measurable: Track progress. For instance, saving ₹15,000 each month.

– Achievable: Set realistic goals that match your income and lifestyle.

– Relevant: Ensure your goals align with your long-term plans and values.

– Time-Bound: Assign deadlines to your goals to maintain focus and motivation.

A Step-by-Step Financial Plan

1. Create a Budget

A budget helps you understand your spending patterns and identify areas to cut. Use the 50/30/20 rule tailored for Indian conditions:

– 50% for essentials: Rent, groceries, utility bills, and transportation.

– 30% for discretionary spending: Eating out, entertainment, hobbies. – 20% for savings and debt repayment: Emergency funds, investments, and loan repayments

Practical Tip

:Use apps like Walnut, MoneyView or ET Money to automate expense tracking and budgeting. Review your budget regularly to make sure you’re on track.

2. Build an Emergency Fund

An emergency fund acts as a financial safety net. Aim to save 3-6 months of living expenses. Start by setting aside a small amount each month in a high-interest savings account or liquid mutual fund for easy access..

3. Clear High-Interest Debt

Debt management is important to avoid financial stress. Focus on clearing high-interest debts like credit cards and personal loans first. Use one of these strategies

– Snowball Method: Pay off smaller debts first for quick wins.

– Avalanche Method: Focus on debts with the highest interest rates to save money in the long run.

Practical Tip:

Avoid the debt trap by using credit cards responsibly. Pay your dues in full each month to avoid interest charges.

4. Start Investing

Wealth creation requires investment. Here are some beginner-friendly options in India:

– Mutual Funds: SIPs (Systematic Investment Plans) in Equity Mutual Funds are ideal for long-term goals.

– PPF (Public Provident Fund): Offers guaranteed returns and tax benefits under Section 80C..

– Stocks: If you’re willing to learn, direct equity investments can provide high returns.

Practical Tip:

Start small and gradually increase your investment amount as your income increases. Consult a financial advisor or use a robo-advisor like Groww or Zerodha for guidance.

5. Get Insurance

Insurance is an important aspect of financial planning:

– Health Insurance: Covers medical emergencies and reduces out-of-pocket expenses. Make sure you have a personal or family floater plan in addition to employer-provided insurance.

– Term Insurance: Protects your family’s financial future. Opt for a coverage of 10-15 times your annual income.

6. Save for Retirement

Start contributing to retirement funds early:

– EPF (Employees Provident Fund): Compulsory savings scheme for salaried individuals.

– NPS (National Pension System): Offers additional tax-saving benefits and flexibility in investment choices.

– PPF: Ideal for long-term goals with assured returns.

Practical Tip: Use online calculators to estimate your retirement corpus and adjust your savings accordingly.

7. Increase financial literacy

7. Increase financial literacy

Educating yourself about personal finance is an ongoing process. Here are some resources tailored for the Indian audience:

– Books like Let’s Talk Money by Monica Halan and Rich Dad Poor Dad by Robert Kiyosaki.

– YouTube channels like CA Rachana Phadke Ranade and Labour Law Advisor.

Suggested Blog Series for Young Professionals in India

Here’s a roadmap for a comprehensive blog series:

1. Introduction to Financial Planning

– Why financial planning is essential for young Indians.

– The impact of starting early and small steps to take.

2. Budgeting for Indian Lifestyles

– Adapting the 50/30/20 rule to Indian scenarios.

– Tools and apps for efficient budgeting.

3. Saving Strategies

– Building an emergency fund step by step.

– Differences between savings accounts and liquid mutual funds.

4. Investing Basics

– Mutual funds and SIPs for beginners.

– Understanding ELSS for tax-saving and long-term goals.

5. Tax Planning in India

– Overview of Section 80C investments like PPF and ELSS.

– Tax-saving strategies for salaried professionals.

6. Retirement Planning

– EPF, PPF, and NPS: What works best for you?

– How to calculate your retirement needs.

7. Insurance Planning

– Importance of health and term insurance.

– Tips for choosing the right insurance policy.

8. Managing Debt

– Strategies to clear credit card debt.

– Managing education loans effectively.

9. Financial Planning for Big Goals

– Buying your first car or home.

– Saving for major life events like weddings or higher education.

10. Monitoring and Adjusting Your Plan

– Tools to track your net worth and investments.

– Conducting annual financial reviews.

Final Thoughts

Financial planning is not about making perfect decisions; It’s about making informants. Start small, create a budget, save for emergencies, and invest in simple tools. As your income and confidence grow, refine your plan and explore advanced strategies. Remember, the sooner you start, the more freedom you’ll have to enjoy life and achieve your dreams while securing your financial future..