Creating a budget is one of the most important steps in managing your money and achieving your goals. For young professionals in India, balancing expenses, savings and lifestyle needs can be challenging, but a good budget can make things easier. This guide will show you how to create a budget that meets your needs and will help you live comfortably while working toward your dreams.

Why Budgeting Matters

A budget doesn’t mean saying no to everything you like. It’s about knowing where your money is going and making sure it’s being spent on things that matter to you. Here’s why you need a budget:

- Stay in Control: A budget gives you a clear picture of your income and expenses so you can avoid overspending.

- Achieve your goals: Whether it’s saving for a trip, buying a car or paying off debt, a budget helps you plan for it.

- Avoid Debt: When you track your spending, you are less likely to rely on credit cards or loans.

- Build Wealth: Budgeting helps you save and invest, which is important to grow your money over time

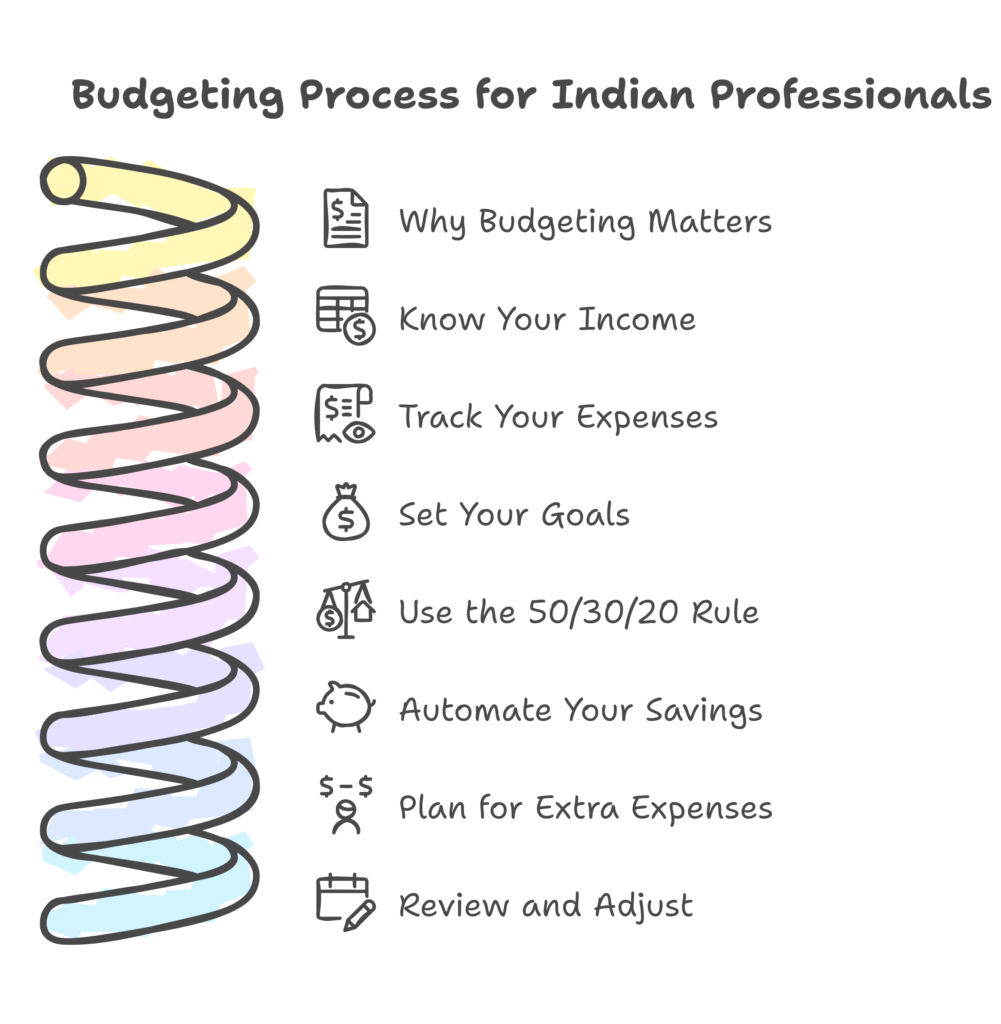

Steps to Build a Budget

1. Know Your Income

Start by calculating how much money you make each month. Include your salary, freelance work or any side income. If you’re salaried, focus on your take-home pay after taxes and other deductions.

Note: If your income varies from month to month, use the average of the previous six months to estimate.

2. Track Your Expenses

Figure out where your money is going by categorizing your expenses:

- Fixed Costs: Rent, EMIs, utility bills, and other regular payments.

- Variable Costs: Groceries, dining out, shopping, and other flexible expenses.

Note: Use apps like Walnut, MoneyView, or even a notebook to track your spending

3. Set Your Goals

Decide what you want to achieve with your money. Your goals might be:

- Short-Term: Saving for a weekend trip or buying a new gadget.

- Medium-Term: Building a down payment for a car or home.

- Long-Term: Investing for retirement or starting a business.

Prioritize your goals so you know where to focus your money.

4. Use the 50/30/20 Rule

This is a simple formula to divide your income:

- 50% for Essentials: Rent, groceries, transportation, and bills.

- 30% for Wants: Eating out, shopping, hobbies, or entertainment.

- 20% for Savings and Investments: Emergency funds, debt repayment, and investments.

Tip: Adjust the percentages if needed. For example, if rent takes up 40%, you can reduce spending on wants.

5. Automate Your Savings

Set up automatic transfers to your savings account or mutual fund investments on payday. This ensures you save before you spend.

Tip: Treat your savings like a fixed bill that you can’t skip.

6. Plan for Extra Expenses

Festivals, weddings, or annual insurance payments can disrupt your budget if you don’t plan for them. Set aside a little every month for these occasions.

Tip: Open a separate account for irregular expenses and add to it regularly.

7. Review and Adjust

Your budget isn’t set in stone. Check it every month to see if it still works for you. If your income or expenses change, update your budget accordingly.

Tip: Use simple tools like Google Sheets or mobile apps to make tracking and adjusting easier.

Common Budgeting Challenges and Solutions

Handling Unexpected Costs

Emergencies like medical bills or car repairs can drain your budget. This is why having an emergency fund is so important. Aim to save at least three months of living expenses.

Tip: Start small by saving ₹5,000-₹10,000 and build from there.

Staying Disciplined

It’s easy to overspend, especially when friends or social media tempt you. Be mindful of your priorities and stick to your limits.

Tip: Use cash or UPI for discretionary spending to avoid running up your credit card balance.

Managing Irregular Income

If you freelance or have side gigs, budgeting can be tricky. Focus on saving more during high-income months to cover the lean ones.

Tip: Base your spending on your lowest monthly income to stay on the safe side.

Budgeting Tools for Indian Professionals

Here are some apps and tools to make budgeting easier:

- Walnut: Tracks expenses automatically by reading your SMS alerts.

- ET Money: Combines expense tracking with investment management.

- CRED: Tracks credit card bills and rewards you for paying on time.

- Google Sheets: A customizable and free tool to create your own budget.

Benefits of Budgeting

- Peace of Mind: Knowing your finances are under control reduces stress.

- Consistent Savings: A budget ensures you save regularly without thinking twice.

- Financial Freedom: You can enjoy life without guilt, knowing you’re on track for your goals.

- Preparedness: Whether it’s a medical emergency or a sudden expense, a budget helps you handle it without panic.

Final Thoughts

Budgeting doesn’t have to be complicated or restrictive. Start by tracking your income and expenses, set achievable goals, and use simple tools to stay on track. Adjust as needed, and don’t forget to celebrate small wins. With a good budget, you can enjoy your present while building a secure financial future.