Achieving ₹10 Lakh by 2025: A Practical Guide..?

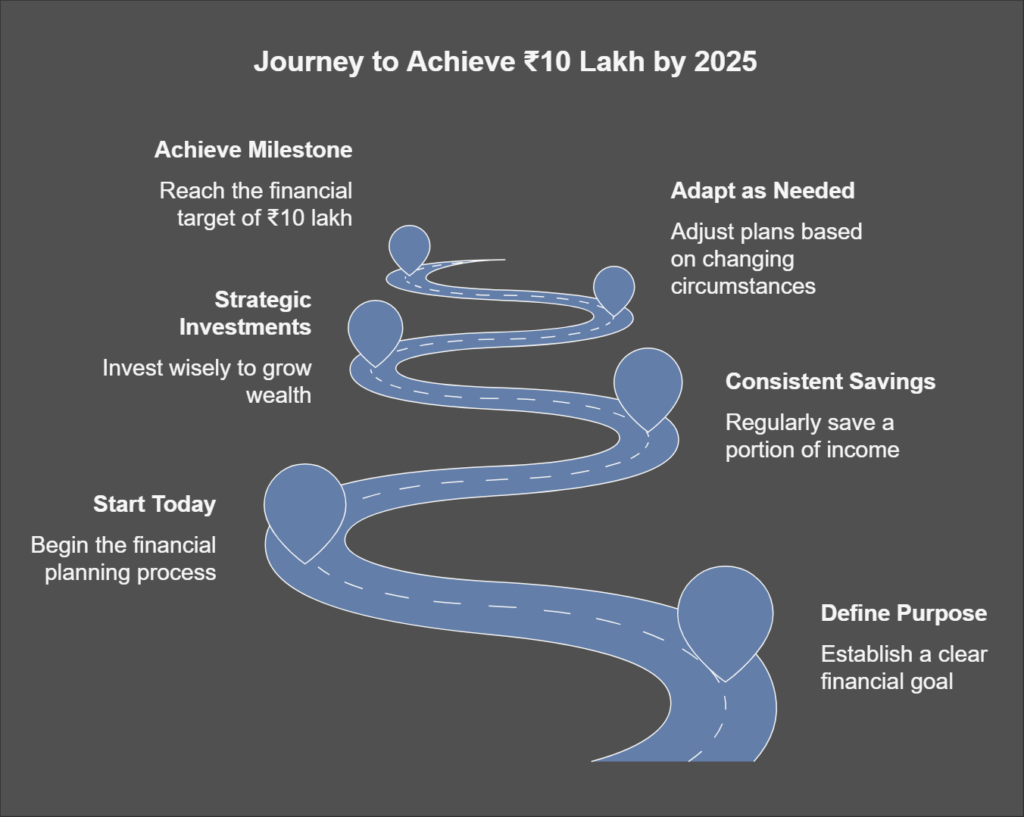

Are you aiming to reach the financial milestone of ₹10 lakh (₹1,000,000) by 2025? Although it may seem challenging at first, a well-organized plan with discipline and smart decisions can make it happen. Here’s a step-by-step guide to help you turn this goal into an achievable target.

Step 1: Define Your Why you want to achieve 10 lakhs by 2025.

Why Do You Want to Achieve This Goal?

It is important to understand your motivation. Are you saving for a dream home, higher education, financial independence or simply building wealth? A clear “why” will motivate you throughout the journey.

Determining the purpose behind this goal helps you create your financial plan. For example, if you are saving for a long-term need, your strategy may include more conservative investments. Conversely, if your goal is short-term, you may focus on higher-return, riskier, alternatives.

Step 2: Break It Down

How Much Do You Need to Save?

To accumulate ₹10 lakh in 2 years, let’s break it down:

- Monthly target: ₹10,00,000 / 24 months = ₹41,667 per month.

- Weekly target: ₹10,00,000 / 104 weeks = ₹96,154 per week.

This calculation provides a structured way to follow. However, your savings pace may change based on investment returns, bonuses or other income streams. Breaking down goals into manageable chunks ensures you stay focused without feeling overwhelmed.

Step 3: Assess your current financial situation

Understanding where you stand financially is an important starting point. Start by assessing your:

- Income: How much do you earn per month with salary, side gigs or passive income?

- Spending: Track your monthly spending habits to identify areas where you can cut back.

- Debt: Focus on clearing high-interest debt first, as it can slow down your savings efforts.

Use this assessment to create a personalized budget. A popular method is the 50/30/20 Rule:

- 50% of income for essentials like rent, groceries and utilities.

- 30% for discretionary expenses such as dining or entertainment.

- 20% for savings and investments.

If your goal requires aggressive savings, consider adjusting these percentages to allocate more towards savings.

Step 4: Maximize Savings (achieve 10 lakhs by 2025)

Practical Tips to Save More

Cut Unnecessary Expenses: Audit your expenses to identify expenses you can cut. For example, cancel unused memberships, dine out less often, or find affordable alternatives to regular purchases.

Negotiate bills: Whether it’s rent, internet or utility bills, negotiating better rates or switching providers can free up extra funds.

Automatic Savings: Set up automatic transfers to a dedicated savings account as soon as your salary is credited. This approach ensures that you save first and spend later.

Embrace Minimalism: Focus on needs over wants. For example, take out loans instead of buying things you rarely use, or prioritize experiences over material possessions.

Track your progress: Use apps or spreadsheets to monitor your savings and make sure you’re on track to meet your monthly goals.

Step 5: Invest Smartly (achieve 10 lakhs by 2025)

Leveraging Investments to Grow Wealth

Saving alone may not be enough, especially as inflation reduces the value of money over time. Strategic investing can accelerate your journey. Here are some options:

Mutual Funds: Start a SIP (Systematic Investment Plan) in equity or hybrid mutual funds. These are ideal for wealth creation over a medium-term horizon.

Stocks: Investing in fundamentally strong companies can yield higher returns. Make sure you do thorough research or consult a financial advisor.

Fixed Deposits (FDs): While offering lower returns than equities, FDs are a safer option for risk-averse individuals.

PPF (Public Provident Fund): It is a government-backed scheme with attractive tax benefits and long-term returns.

Index Funds: These track market indices and offer diversification, making them a reliable investment for beginners.

Expected Returns

- Equity: ~10-12% p.a

- Mutual Funds: ~8-10% p.a

- Fixed Deposits: ~5-7% p.a

Building a diversified portfolio based on your risk appetite ensures balanced growth while minimizing potential losses.

Step 6: Create Additional Income Streams (achieve 10 lakhs by 2025)

If your current income isn’t sufficient to meet your savings goal, consider building multiple income streams. Here are some ideas:

Freelancing: Offer skills like writing, graphic design, coding or digital marketing on platforms like Upwork or Fiverr.

Property for Rent: Earn passive income by renting out unused space, vehicles or gadgets.

Selling Products Online: Platforms like Amazon and Etsy allow you to sell homemade or resale items.

Teaching or Tutoring: Share your expertise in subjects, music or fitness through online or offline classes.

Even an extra ₹10,000 per month can increase your savings significantly.

Step 7: Stay Disciplined and Track Progress

Consistency is the key to achieving any financial goal. Here’s how to stay on track:

- Set Milestones: Break your ₹10-lakh target into smaller chunks (eg ₹2.5 lakh every 6 months). Achieving these milestones will motivate you to keep going.

- Regular Reviews: Monitor your progress monthly. Adjust your savings, investments or spending as needed to stay aligned with your goals.

- Celebrate Small Wins: Reward yourself for achieving milestones, but make sure these celebrations fit within your budget.

Step 8: Avoid Common Pitfalls

- Over-spending: It’s easy to get sidetracked by lifestyle inflation, especially with a raise or bonus. To avoid this, stick to your budget.

- Ignoring Emergencies: Always have an emergency fund that covers 3-6 months of expenses. This safety net prevents you from dipping into savings in unexpected circumstances.

- Follow Anonymous Investment Advice: Avoid “get rich quick” schemes or unverified financial tips. Do thorough research and seek expert advice if in doubt.

- Delay: Delaying the start of your savings plan can make the journey more challenging. Start as early as possible to take advantage of the power of compounding.

Practical Example: Achieving the Goal

Suppose your monthly income is ₹50,000 and your current expenses are ₹30,000. By reducing expenses by ₹5,000 and earning an additional ₹10,000 through freelancing, you can save ₹25,000 monthly. Invest this amount in equity mutual funds with an average annual return of 10% to reach your ₹10-lakh target over the desired period.

Final Thoughts (achieve 10 lakhs by 2025)

Reaching ₹10 lakh by 2025 is undoubtedly ambitious, but not impossible. With a clear purpose, disciplined savings and strategic investments, you can make this dream a reality. The key is to start today, be consistent and adapt as needed.

Every small step you take brings you closer to financial freedom. Remember, the journey is as important as the destination. By reaching this milestone, you will not only secure your financial future but also gain the confidence to set and achieve even bigger goals.

Are you ready for your ₹10 lakh journey? Let’s make it happen!